Although mobile network operators, especially in developed markets, are turning to 5G standalone (SA) networks so they can take full advantage of 5G technology across the radio access and their core networks, uptake still remains patchy. The business case for 5GSA is still unclear for many use cases, although connected vehicle applications from rich infotainment through to advanced driver assistance systems (ADAS) at various levels and autonomous driving, are near-dependent on low latency, high availability 5G.

With the global base of connected cars set to hit 1.261 billion in 2035[1], it’s clear that many new vehicles will need to be able to connect to 5G technology. It’s becoming a question of accepting operators’ 5G NSA offerings today at the same time as demanding 5G SA access in future. There are significant differences between 5G non-standalone (NSA) and 5G SA to be taken into account.

5G NSA networks combine existing LTE networks with a new 5G radio access network (RAN) to deliver some of the extended mobile broadband benefits of full 5G but enabling these at far lower cost while utilizing existing LTE/4G architecture. In contrast, 5G SA features both a 5G RAN and cloud native 5G core network. This means that 5G SA provides a comprehensive end-to-end 5G experience that combines ultra reliable low latency communication (URLLC) and massive machine type communication (mMTC) which are fundamental enablers of connected vehicle use cases.

The way to go

This suggests that 5G SA is ultimately the way for mobile operators to go because of the seamless, low latency, high throughput connected experience it can provide to vehicles and fleets, among other verticals. However, 5G SA is an expensive investment and this is prohibitive for many markets. In these places, greater deployment of 5G NSA is occurring, bringing some 5G-like attributes to users. This is to be welcomed because it supports users’ needs for greater data throughput but it doesn’t deliver on the full 5G promise.

This fractured roll-out is seeing advanced markets invest in 5G SA with the aim of bringing full 5G capabilities to markets that can generate substantial revenues such as manufacturing, automotive and robotics while markets that are more investment-constrained are deploying 5G NSA to bring some 5G attributes, such as improved base-level connectivity, to users today.

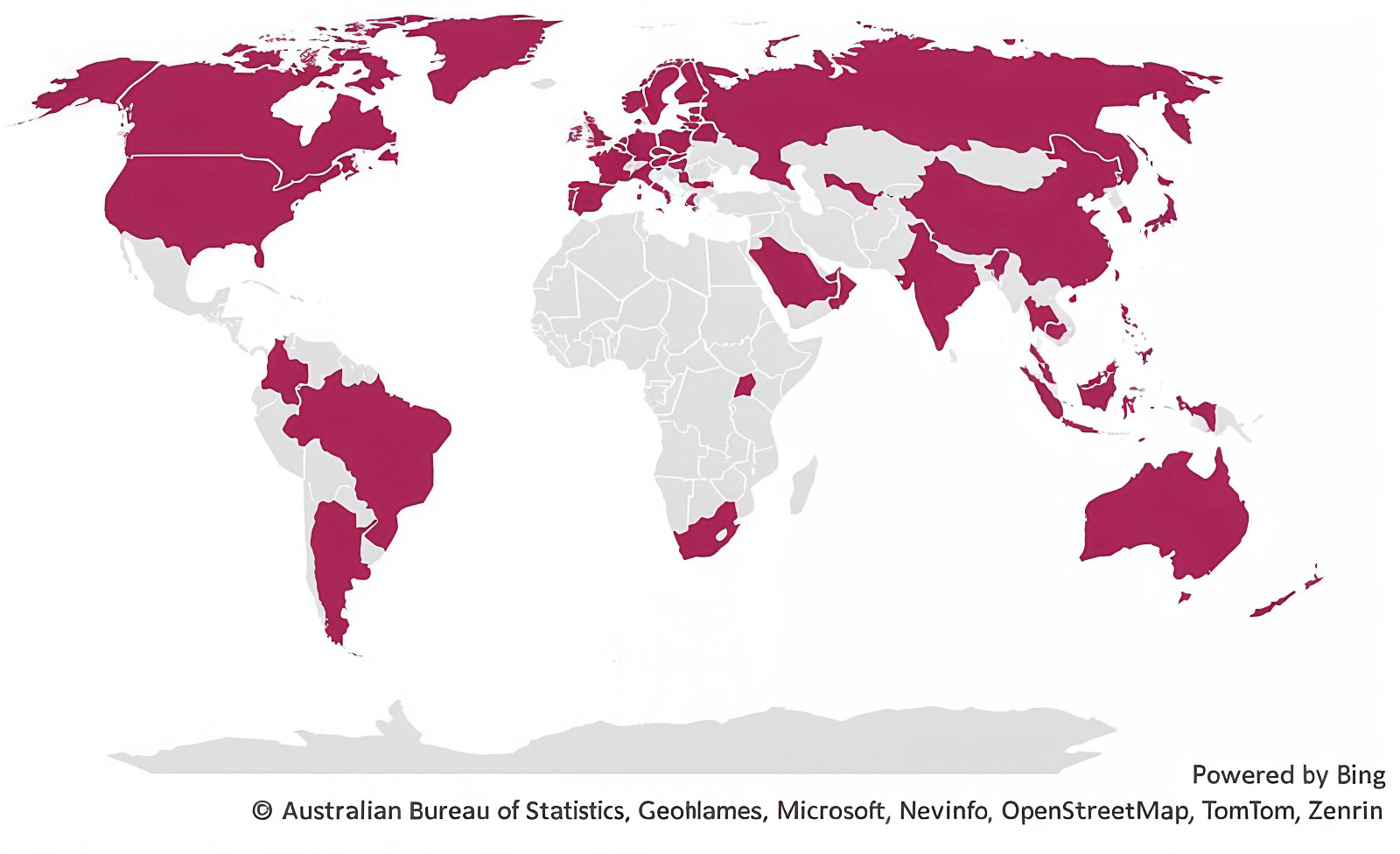

Vendor organization, GSA[2], has identified 163 operators in 65 countries and territories worldwide that have been investing in public 5G SA networks through trials, planned or actual deployments. This equates to just 25.7% of the operators known to be investing in any 5G licences, trials or deployments.

5G SA investment constraints

Operators worldwide have sought to invest in their 5G networks and launch 5G SA technology, the organization says, pointing out that Europe, the Middle East and Africa boast the largest number of launches, with 34. GSA found that the Asia Pacific region initially had the most operators launching 5G SA, with Europe, the Middle East and Africa experiencing a more gradual increase before eventually taking the lead.

Europe now makes up the majority of investment activity in the Europe, Middle East and Africa region. Only three countries in Africa are currently investing in the technology. The Central and Latin America region is witnessing steady progress, with nine operators in five countries investing in 5G SA technology. At least 73 operators in 39 countries and territories are now understood to have launched public 5G SA networks, two of which have only soft-launched their 5G SA networks.

Figure 1. Countries and territories with operators identified as investing in public 5G SA networks

This level of 5G SA adoption is modest and highlights the investment pressure operators outside of the regions shown in Figure 1 are under. According to analyst firm Analysys Mason[3], the number of new 5G SA networks launched actually fell in 2024; Ten 5G SA networks were launched worldwide, compared to 14 in 2023 and 18 in 2022.

Major operators such as EE (BT), MasOrange and Virgin Media O2 are continuing to expand their coverage of 5G SA, but others remain hesitant to deploy 5G SA due to concerns about its business case and the potential for a limited return on investment. The firm says this was also true with 5G NSA with operators struggling to find justification for investment in the technology.

5G NSA sees uptake in emerging regions

Operators in the emerging regions of EMAP, LATAM and sub-Saharan Africa (SSA) continued to invest in 5G NSA networks in 2024, says Analysys Mason. Operators in these regions accounted for 74% of all 5G NSA launches in 2024. Operators in SSA, for example, have launched the most 5G networks since the beginning of 2022; they have accounted for 29% of all launches worldwide in the past three years. SSA now has a total of 43 active 5G networks in 23 different countries.

The big change we are now seeing is that the business case for a cloud-based 5G core is crystallizing. The first iteration of 3GPP’s 5G-Advanced standards is now frozen and the firm says developments in network AI and automation are continuing to improve the business case for cloud-native networks.

Wireless Mobility would add that the current wave of connected vehicles increasingly contain embedded technology that could be more fully exploited with ubiquitous access to 5G SA. In the meantime, 5G NSA provides a RAN uplift over LTE performance that is of significant benefit to connected vehicles. As vehicles become better connected and move through the levels of ADAS, robust, secure 5G connectivity will become a prerequisite for supporting vehicle connectivity. 5G NSA is an improvement today but the ultimate destination is 5G SA.

WirelessMobility’s 5G products and services cover both NSA and SA modes. To learn more about how Wireless Mobility can help you advance your connected deployment for the road ahead, reach out to us today.

[1] https://omdia.tech.informa.com/om122929/connected-car-report-2024

[2] https://gsacom.com/paper/5g-standalone-april-2025/

[3] https://www.analysysmason.com/research/content/articles/5g-deployments-worldwide-rma18/